Business Report Investor presentation

Investor presentation

The exceptionally difficult and progressively more challenging market environment witnessed during the first half of 2022 also created strong headwinds for Bellevue Group and left a mark on its operating performance. The detailed figures on the half year results can be found in the presentation.

Market related decline in AuM base amplified by distinctive positioning

Market related decline in AuM base amplified by distinctive positioning

Development in assets under management 2017 – H1 2022

AuM temporarily dips to average level of 2019

- Significant decline in AuM of approx. CHF 3.2 bn or 25% in H1

- More than CHF 2.8 bn or almost 90% of the overall decline is attributable to lower market valuations

- The rate hike announced by the SNB on June 16, 2022, briefly lowered the market value of AuM by more than CHF 400 mn

- Despite the considerable market turbulence, the client base has remained extremely stable

- Overall well-balanced asset base, margin remains attractive

Very stable client base – marginal outflow

Very stable client base – marginal outflow

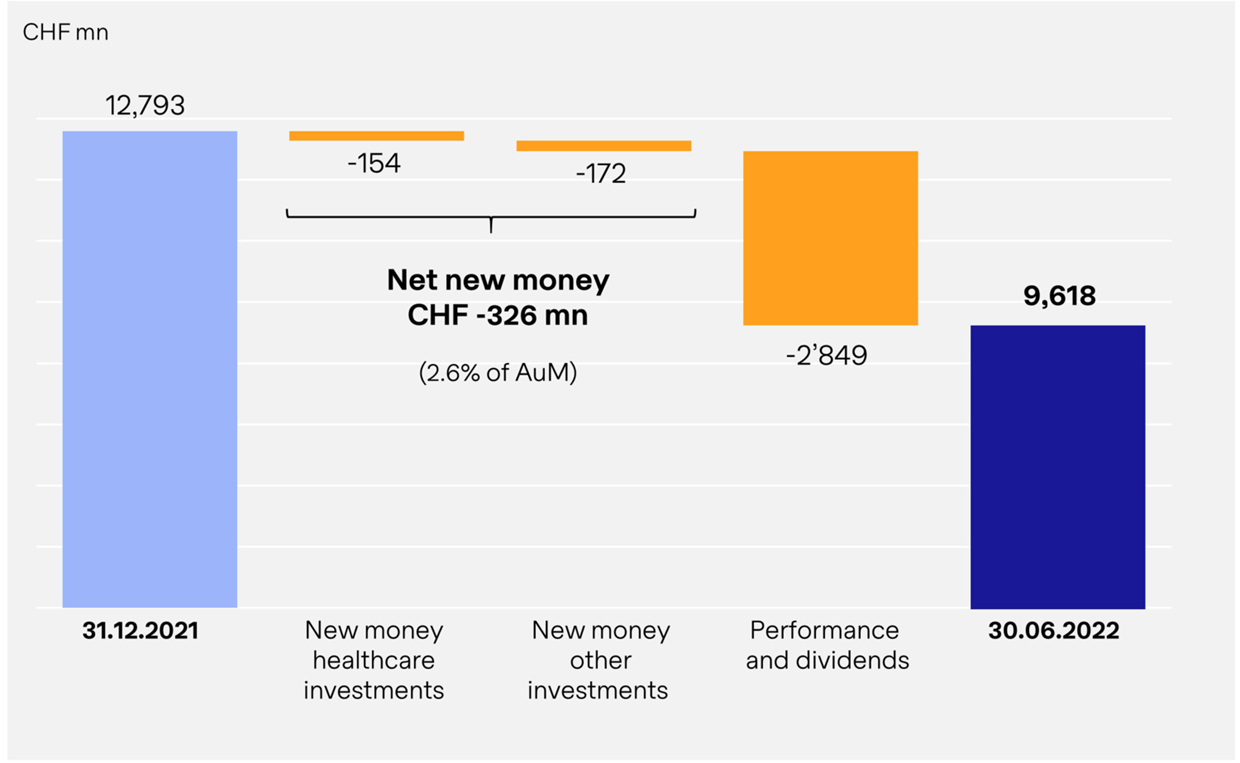

Change in AuM in H1 2022

Solid client base reflects high level of trust and long-term orientation

- Significant decline in AuM base largely attributable to negative performance

- Negligible asset outflow (<3% of the AuM base) compared to major market impact

- Part of the net outflow stemmed from ongoing product realignment (virtually completed now)

Mixed earnings power in tandem with market trend

Mixed earnings power in tandem with market trend

Management fees and average AuM, H1 2017 – H1 2022

Business model clearly dependent on general stock market environment

- Linear decline in management fees compared to market developments

- Management fees are calculated based on average AuM, which “smooths out” periods of high volatility

- Earnings power in H1 2022 comparable to level from H2 2020

- Profitability is largely driven by recurring income (management fees)

- Ongoing adjustment and optimization of product mix has stabilized margin quality at a high level

Consolidated results

Consolidated results

- Reduction of asset management services is driven by lower AuM; no significant change in performance fees and other net commission income

- The negative stock market trend resulted in unrealized and non-recurring losses of CHF 4.0 mn on investments in own products and a CHF 4.7 mn net loss on financial investments in connection with employee compensation plans

- Absolute decline in total operating income of CHF 26.8 mn is mainly attributable to:

- Income from core asset management services business declined CHF 16.3 mn (22% vs. prior-year figure) because of lower average level of AuM

- Change in non-recurring financial income totaling CHF 11.7 million (16% vs prior-year figure)

Operating expenses at a glance

Operating expenses at a glance

- Bellevue's entrepreneurial compensation model led to lower performance-related compensation in the wake of lower operating income

- Headcount unchanged vs prior-year period

- Other operating expenses stable vs prior-year period

- Slight increase in cost-income ratio (CIR) to 59% due to unrealized losses on financial investments

- The entrepreneurial compensation model smooths out CIR during adverse market conditions and confirms the positive downward trend

- Steady efficiency gains possible thanks to scalable business model