Product highlights

Stock markets showed little regard for the pandemic at times in 2021 and new record highs were set. Growing inflationary pressure, new virus variants and supply chain constraints around the world eventually led to greater volatility in financial markets. Despite these shifting market dynamics, Bellevue achieved attractive returns for its investors and pleasing results overall.

The primary driver of these results was the healthcare sector, which has evolved into a major long-term investment theme. Many existing clients increased their exposure to the healthcare sector last year while first-time clients became convinced of the importance of healthcare investments. 67% of Bellevue's assets under management beat their respective benchmark in 2021 and, in a direct comparison with peers, 72% of its assets under management ranked in the first or second performance quartiles. Bellevue continued to maintain high levels of management continuity while also selectively expanding the competencies of individual investment teams with new talents representing a variety of different backgrounds.

A range of distinctive investment skills for an attractive range of products

1) AuM comprises all Lux and CH funds, as well as BB Biotech AG and BB Healthcare Trust plc.

2) Strategies without a benchmark were excluded from this analysis; outperformance net of fees.

Core healthcare strategies attract more than CHF 1 bn for the first time

Assets under management increased by 6.3% to CHF 12.8 bn in 2021 thanks to new money inflows and performance-driven growth. Greater investor interest in healthcare themes led to a renewed inflow of more than CHF 1 bn in new money for the Group's core healthcare investment business, although some healthcare strategies experienced weaker momentum and demand during the second half due to broader market movements. Inflows were strongest at Bellevue Medtech & Services, Bellevue Digital Health and BB Healthcare Trust.

Strong net new money inflows in the areas of healthcare and private equity were diminished by outflows from Bellevue Global Macro. The wind-down of undifferentiated investment strategies with low margins was completed in preparation for the full integration of StarCapital.

Net new money of CHF 722 mn (excl. product streamlining) was mostly acquired during the first half of the year.

Healthcare – strong performance in the first half, declining momentum in the second half

Global stock markets tacked on more strong gains in 2021. The upward trend was fueled by the continued ultra-expansive monetary policy of major central banks, massive government spending programs, and the rapid progress of vaccination campaigns in the US and Europe. In this setting, the global healthcare sector was no longer able to keep up with the performance of the broader market, especially during the second half of the year. This situation must also be seen in the context of the healthcare sector's significant outperformance in 2020, so this reflects to some extent the gradual normalization of economic activity after the pandemic-induced contraction in the spring of 2020.

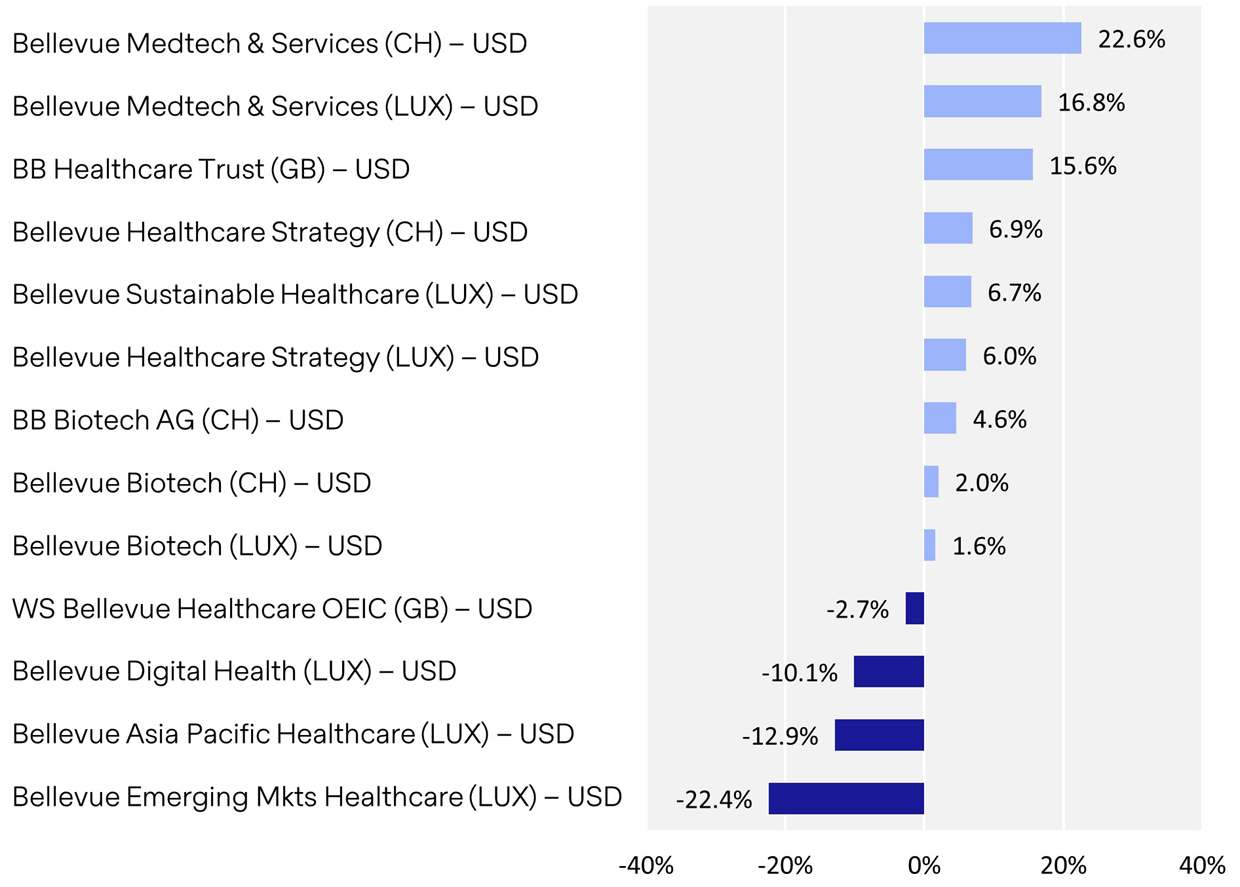

In 2021 healthcare investors focused on the two vaccine producers Moderna and Pfizer/Biontech as well as large and mega cap healthcare stocks, particularly in the pharma subsector. This situation is illustrated quite well by the following charts:

The large/mega cap Russell 1000 Healthcare Index clearly outperformed the small and mid cap Russell 2000 Healthcare Index in 2021. That contrasts sharply with the performance of these indexes in 2020, when small/mid cap healthcare companies outperformed large cap healthcare companies by a wide margin. Bellevue Asset Management has concentrated its investments on small and mid cap companies due to their strong growth momentum and superior innovative power and this hurt its portfolio returns during the year under review.

After performing very well in 2020, BB Biotech AG’s performance in 2021 was subpar. mRNA vaccine manufacturer Moderna, in which BB Biotech first invested in 2018, made significant gains again, driven by the effectiveness of its COVID-19 vaccine, but many of the small/mid cap positions in the portfolio had a negative impact on performance, particularly during the second half of the year. BB Biotech’s NAV declined by 14.2% in USD. Its stock price was up 5% (NBI +0.0%), however, which led to an increase in the share premium. At year-end, Moderna was the largest position in BB Biotech AG’s portfolio.

Despite its overweighting of mid caps, London-listed BB Healthcare Trust closed the year with a return of 15.6% (in USD), only slightly behind the MSCI World Healthcare Index. Its portfolio is focused on companies that are benefiting from the rapid change sweeping through healthcare systems. Currently overweighted subsectors include the biotech, diagnostics, and health insurance (managed care) subsectors. Two portfolio positions that drove performance last year were GW Pharmaceuticals and Hill-Rom Holdings, two companies that were acquired by Baxter and Jazz Pharmaceuticals, respectively, in 2021.

Among Bellevue’s healthcare funds, the Bellevue Medtech & Services Fund delivered the strongest absolute performance (+16.8%, in USD), and also beat its benchmark, the MSCI IMI Healthcare Equipment & Supplies Index. Many hospital beds were filled with COVID-19 patients in 2020, resulting in the postponement of elective and non-emergency surgical procedures. As the capacity situation gradually normalized, many of these procedures have since been rescheduled. The fund's performance was also fueled by US health insurers such as UnitedHealth, Anthem and Centene. As the year progressed, the «double whammy» of higher pandemic-related costs and the resumption of previously postponed medical treatments had less of a negative impact on health insurance companies than the market had expected, which triggered a strong relief rally, especially in the fourth quarter.

The Bellevue Biotech Fund ended the year with a performance of (+1.6% in USD) and also beat its benchmark, the Nasdaq Biotech Index (NBI). Moderna and Biontech, the two mRNA vaccine producers, made positive contributions to this fund's absolute performance, while investments in small and mid cap biotech companies detracted.

After delivering the best return of all the Group’s healthcare products in 2020 (+68.4%, in USD), the Bellevue Digital Health Fund consolidated in 2021 and ended the year with a negative performance of 10.1%. This can be traced to renewed pandemic-related worries about growth and to the US Federal Reserve's decision to taper its QE program and slowly tighten its monetary policy, which weighed on investor sentiment. Small and mid cap growth stocks, which represent most of the Bellevue Digital Health Fund's portfolio, were affected most by this situation, despite reporting generally excellent company results.

The two regional healthcare funds Bellevue Asia Pacific Healthcare (-12.9% in USD) and Bellevue Emerging Markets Healthcare (–22.4% in USD) also ended the year with negative returns. Both showed a positive performance at the mid-year mark, but their exposure to Chinese healthcare stocks hurt their performance in the second half. Government intervention in China caused some turmoil in the country's stock market. Selling was not just limited to the industries directly affected by government meddling (education, IT, etc.). Other sectors known for their stability witnessed some profit-taking and risk premiums for Chinese investments generally increased.

The global healthcare investment solutions Bellevue Healthcare Strategy and its sustainable sister fund Bellevue Sustainable Healthcare returned 6.0% and 6.7% (in USD) year-on-year, which placed them behind the full-year performance of the broad healthcare sector. This is attributed to the two fund's considerable mid cap exposure and their approximately 25% allocation to emerging market stocks. Those two factors are what drove the funds’ significant outperformance in the previous year.

Specialized healthcare strategies

Absolute performance 2021

Alternative strategies – momentum in private equity

Considerable progress was made during the year under review in expanding the private markets business. In February, BB Entrepreneur Private KmGK, an investment company that provides growth financing to SMEs, was successfully launched. At the end of the year the Bellevue Entrepreneur Private Fund, which invests alongside Bellevue adbodmer’s group of investors, received CHF 55 mn in capital commitments from more than 60 investors.

Brisk investment activity has already led to the investment of 30% of the capital commitments, in five Swiss SMEs from a variety of industries. The companies in the portfolio are thriving despite the repercussions of the pandemic. The fund also participated in a capital increase by one of the companies, which used the proceeds to expand its production capacity. This opportunity was preceded by a strong inflow of new orders and the pleasing development of medium-term projects. A partial sale of shares held by the majority shareholder of another portfolio firm was also arranged with third parties in a transaction conducted at a significantly higher valuation.

The long-standing, extensive network of Bellevue adbodmer is producing a steady stream of new and exclusive investment opportunities throughout the so-called DACH region, which refers to the German-speaking parts of Europe. Fundraising for the Bellevue Entrepreneur Private Fund is scheduled to close in Q1 2022.

The absolute return strategy Bellevue Global Macro fell short of expectations in 2021, having ended the year with a negative return of (2.9% in EUR). This underperformance is partially attributed to the neutral portfolio allocation, 75% of which was in government bonds (10y US Treasury yields rose from 0.9% to 1.5%), and the portfolio was 100% hedged against the USD (which appreciated by about 7% versus the EUR in 2021). In the fund's equity allocation, positions in Asian or Japanese stocks and in the biotech sector generated clearly weaker returns compared to the broader equity market.

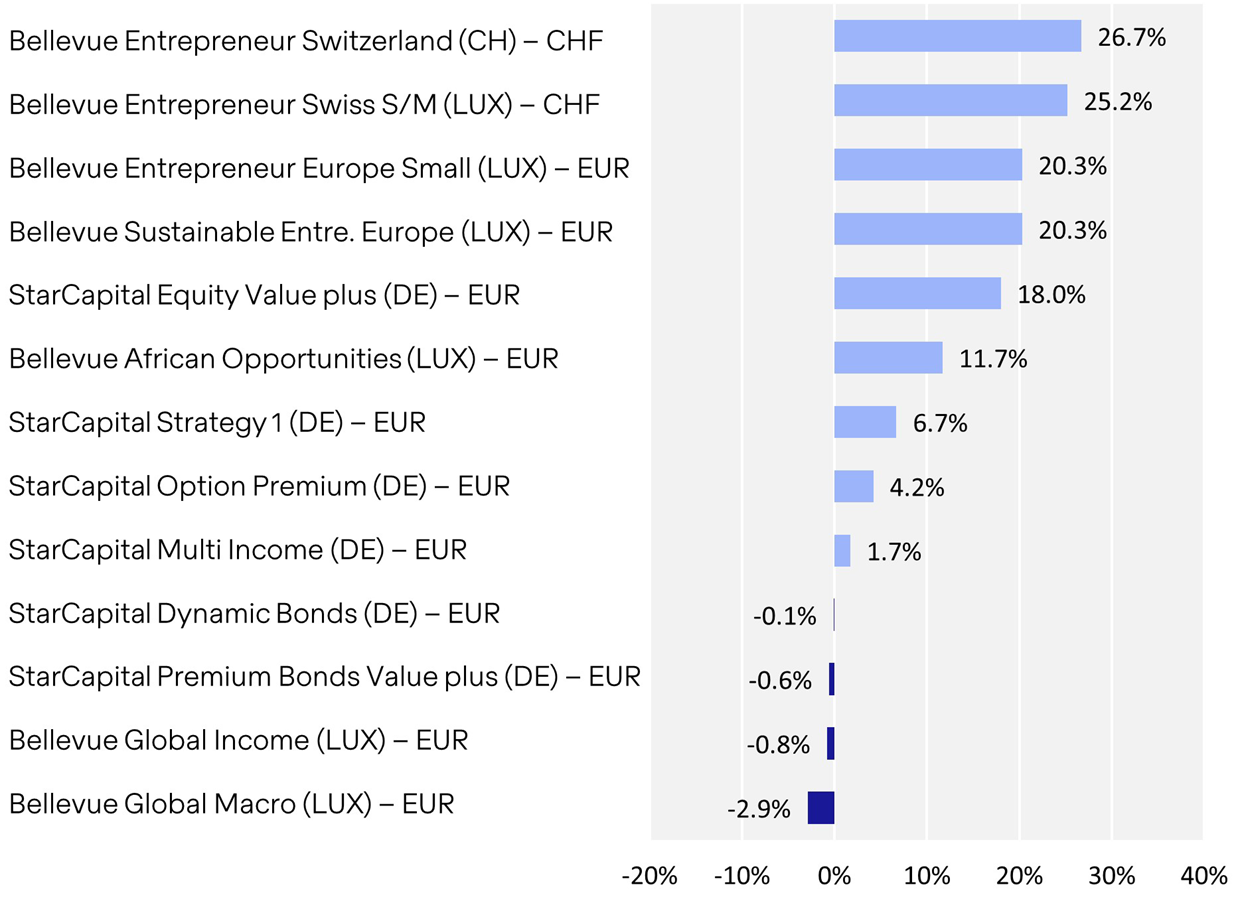

Traditional strategies – Swiss vehicles surge ahead

In Bellevue's traditional strategies, its Entrepreneur funds delivered double-digit returns in 2021. Bellevue Entrepreneur Switzerland (+26.7%) and Bellevue Entrepreneur Swiss Small & Mid (+25.2%), the two funds focused on the Swiss stock market, were excellent performers. Thanks to their active investment strategy, they even beat the strong performance of the benchmark indexes SPI and SPI Extra by 3.3% and 3.0% (in CHF) respectively. The Bellevue Entrepreneur Europe Small Fund and Bellevue Sustainable Europe Fund did not quite match the performance of their benchmarks, but with annual returns of 20.3% in EUR, they likewise produced stellar absolute returns. The Bellevue Sustainable Entrepreneur Europe Fund (formerly BB Entrepreneur Europe Fund) was converted into a sustainability-oriented fund and, after successfully completing a stringent ESG due diligence process, subsequently certified with the internationally recognized FNG label in November.

Last year was a difficult year for emerging markets, but the Bellevue African Opportunities Fund (11.7%, in EUR) delivered an attractive return and once again demonstrated its excellent portfolio diversification qualities. Portfolio positions in Morocco, Egypt and Kenya made positive contributions to performance.

At StarCapital, its crossover corporate bond strategy (BB- to BBB+) StarCapital Dynamic Bonds ended the year with an only slightly negative performance (-0.1%). The StarCapital Equity Value plus Fund (+18.0%) profited from the market's greater interest in value stocks. The recently launched StarCapital Option Premium Fund also deserves special mention. This new product specializes in pair trades, combining put options on US equity indexes with call options on volatility indexes. This strategy aims to generate a stable flow of income with this options concept and it has achieved a return of 4.2% since launch.

Traditional and alternative investment strategies*

Absolute performance H1 2021, in base currency

* Only related to liquid investment strategies (excl. Private Equity)