Business Report Financial Highlights

Financial highlights

Bellevue Group performed well in the first half of 2021 in an exceptional market environment as a pure, specialized asset manager. You will find the financial highlights and the detailed presentation here.

Presentation half-year results

Here you will find all information on the half year 2021 results.

Find out more

Client assets at a new all-time high – despite persisting uncertainties

Client assets at a new all-time high – despite persisting uncertainties

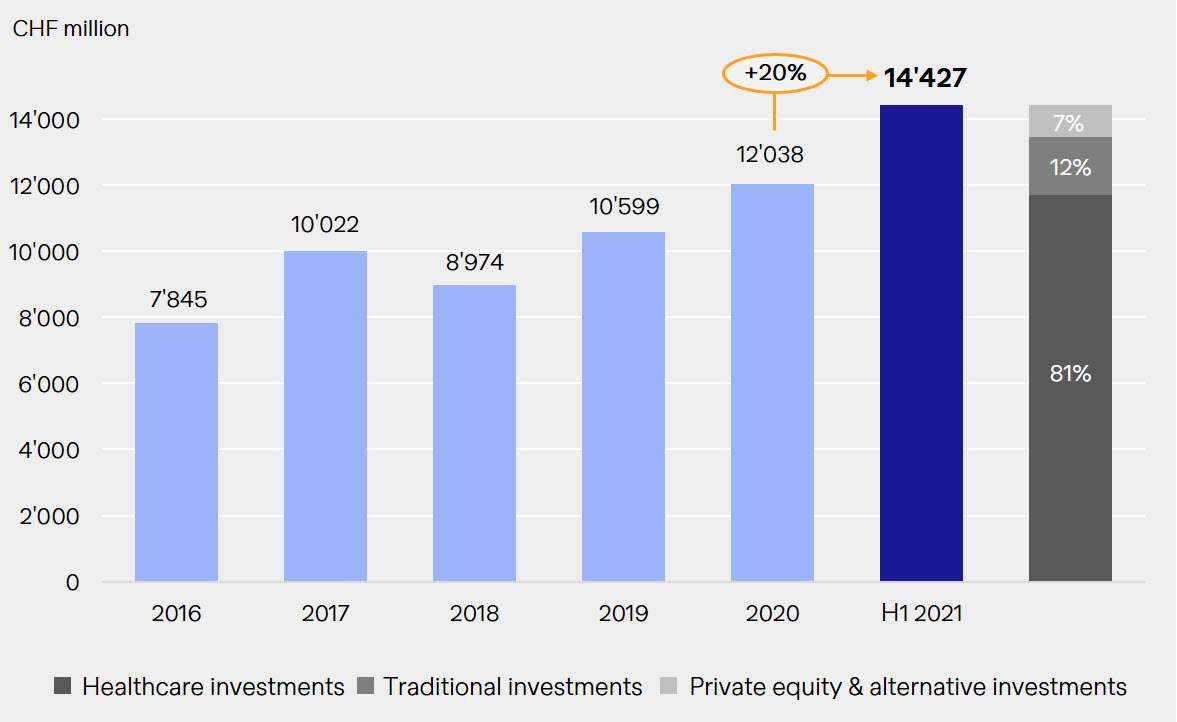

Assets under management climb to a new record high of CHF 14.4 bn

- Significant increase in AuM of nearly CHF 2.4 bn or 20% in H1 2021

- Compelling growth driven by solid investment performance and strong new money inflows

- Proven investment competencies and product range ensure sustained growth

- Continued focus on alternative investment strategies (incl. private equity) and innovative product developments

Strong new money inflow in core business

Strong new money inflow in core business

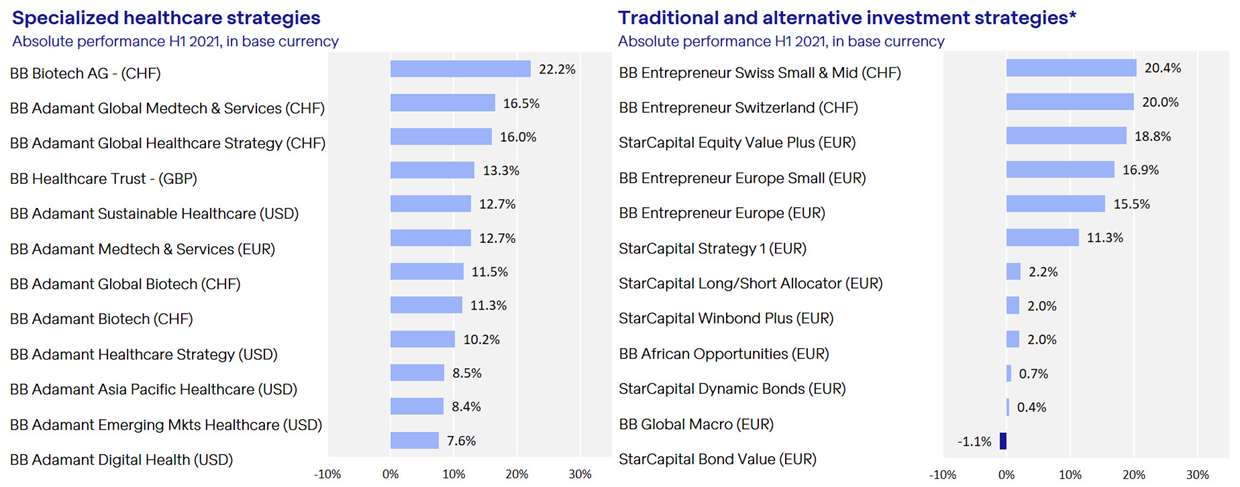

Strong new money inflows in core business with attractive margins

- More than 70% of overall growth driven by performance

- Net new money of nearly CHF 700 million (>10% p.a.), at the high end of target range

- Differentiated alternative investment solutions (incl. the new “Private Markets” unit) prove to be very stable

- Less differentiated investment strategies with slim margins remain under pressure, resulting in further adjustments to product range

- Overall well-balanced asset base, a renewed improvement in the margin

Competitive performance in an inflationary market environment

Competitive performance in an inflationary market environment

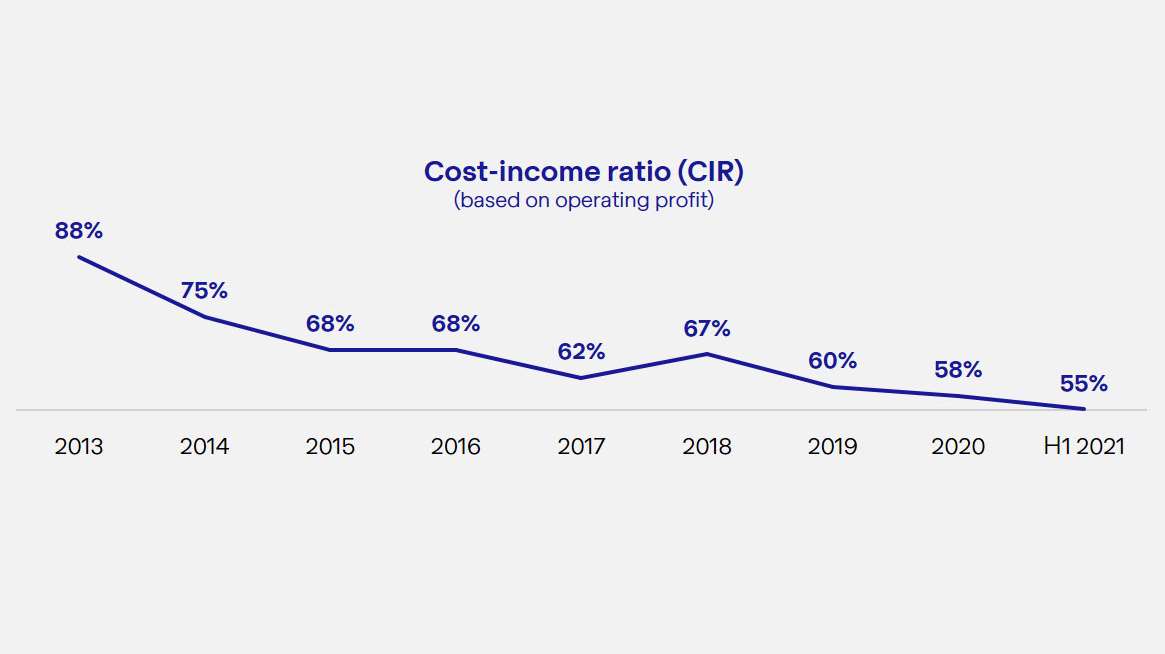

Further improvement in the cost-income ratio

Further improvement in the cost-income ratio

- Further improvement in the cost-income ratio to 55% thanks to significantly improvement in profitability and proportionally slower cost growth

- CIR based on operating profit confirms the positive downward-pointing long-term trend

- Steady efficiency gains possible thanks to scalability model

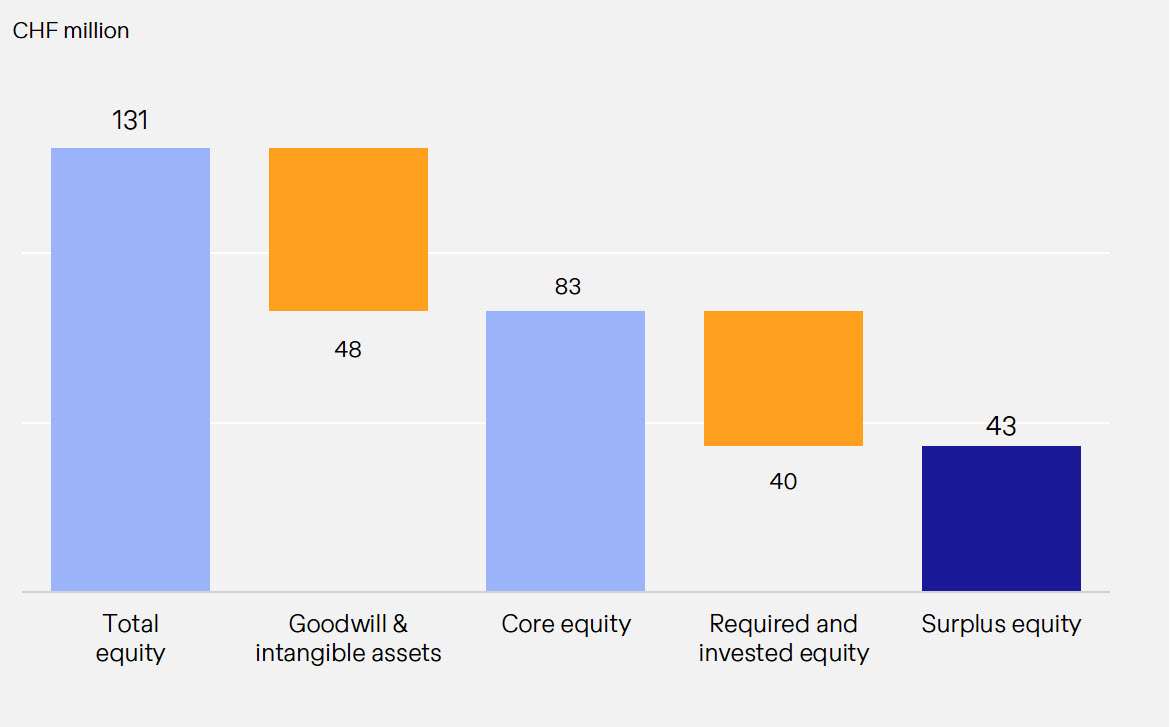

Capital structure and management

Capital structure and management

- Equity capital remains solid thanks to sustained earnings power

- Reduction in goodwill & intangibles (prior year: CHF 53 mn), which reflects ordinary deprecation and value adjustments at StarCapital

- Required level of regulatory minimum capital as a pure asset manager is lower, enabling a very attractive return on equity

- Reserves of CHF 43 mn a sound cushion ensuring steady and attractive payouts as well as further growth

- Simple and debt-free balance sheet